MarketLens

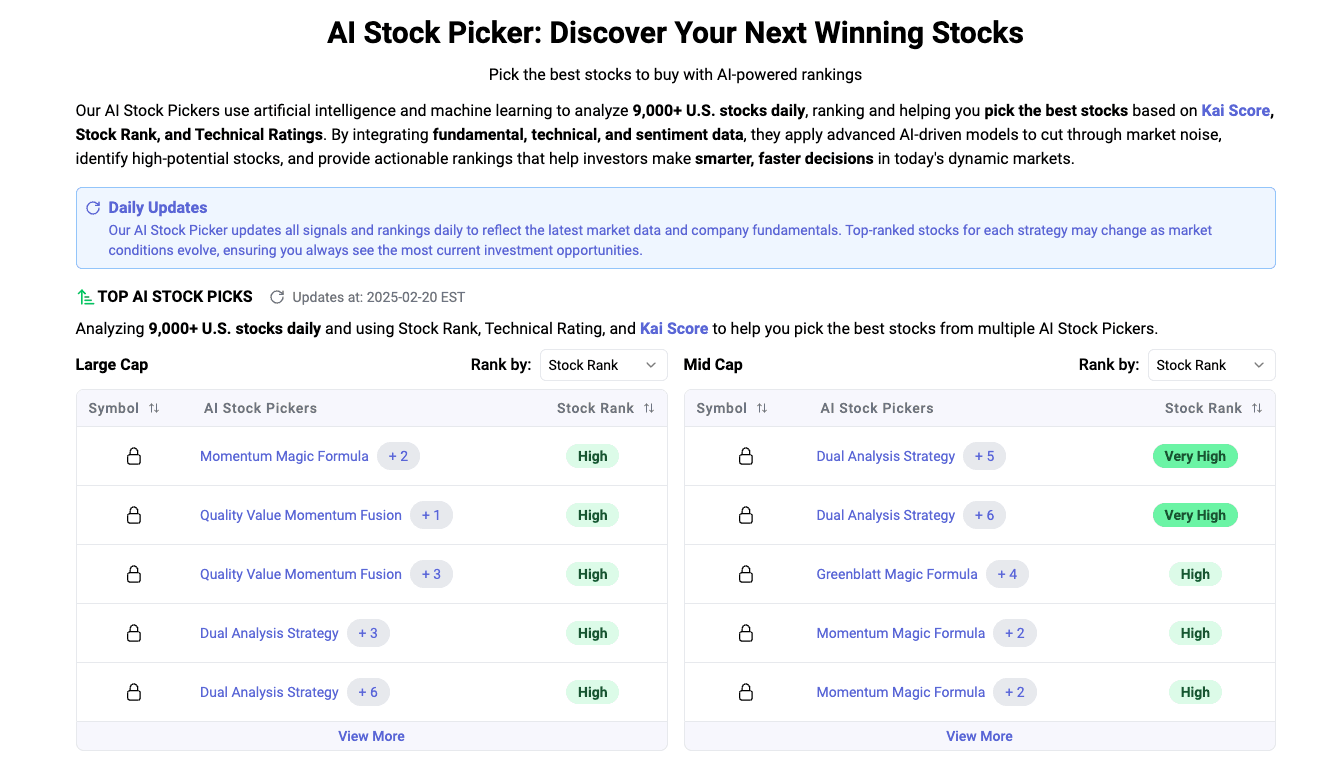

Why Chubb is Congress’s Hidden Gem: The Insurance Stock with Strong Growth and Stability

Chubb Limited (NYSE: CB), one of the largest insurers globally, has garnered significant attention from Congress members over the past 90 days. This report delves into the reasons behind this bipartisan interest, focusing on Chubb’s strong revenue and earnings growth, its reputation as a solid dividend grower, and its overall financial stability. The analysis aims to provide a comprehensive understanding of why Chubb is considered an underrated yet highly promising investment in the insurance sector.

Introduction

Financial Performance and Market Position

Revenue and Earnings Growth

Chubb Limited has demonstrated impressive financial performance, particularly in the past year. As of September 27, 2024, the company reported a trailing twelve months (ttm) revenue of $53.62 billion and a net income of $9.72 billion. This marks a significant increase from the previous year, where revenue stood at $49.70 billion, reflecting a 16.08% growth. Earnings surged by an astounding 72.09% to $9.03 billion, showcasing the company’s ability to generate substantial profits.

In the most recent quarterly earnings report, Chubb exceeded analysts’ expectations with an earnings per share (EPS) of $5.38, surpassing the consensus estimate of $5.04. The company generated revenue of $13.36 billion, an 11.8% year-over-year increase. These figures underscore Chubb’s strong market position and its capability to deliver consistent financial growth.

Market Capitalization and Stock Performance

Chubb’s market capitalization stands at approximately $116.97 billion, positioning it as a major player in the insurance industry. The stock price, as of September 27, 2024, is $289.57, reflecting a slight decrease of $0.27 (-0.09%) from the previous close. The stock has a 52-week range of $204.15 to $294.18, indicating a relatively stable performance with moderate volatility.

The company’s price-to-earnings (PE) ratio is 12.23, with a forward PE of 12.89. These metrics suggest that Chubb is reasonably valued, especially considering its strong earnings growth. The stock’s beta of 0.67 indicates lower volatility compared to the broader market, making it a safer investment during uncertain economic conditions.

Dividend Growth and Yield

Dividend Aristocrat Status

Chubb Limited is recognized as a Dividend Aristocrat, a title given to companies that have consistently increased their dividend payouts for at least 25 years. This status is a testament to Chubb’s financial stability and its commitment to returning capital to shareholders. The company announced a quarterly dividend of $0.91 per share, payable on October 4, 2024, representing an annualized dividend of $3.64 and a yield of 1.26%.

Payout Ratio and Dividend Growth Rate

Chubb’s payout ratio is a low 16.16%, indicating that the company retains a significant portion of its earnings for reinvestment and growth. This low payout ratio, coupled with a trailing earnings growth rate, suggests that Chubb can continue to increase its dividends reliably in the future. The company’s strong cash flow and earnings growth further support its ability to sustain and grow its dividend payouts.

Institutional and Congressional Interest

Institutional Holdings

Institutional investors hold a significant portion of Chubb’s stock, with 83.81% of the shares owned by such investors. Notable institutional activities include Magnolia Capital Advisors LLC taking a position worth approximately $13.18 million, purchasing 51,677 shares in the second quarter of 2024. Other firms, such as Pathway Financial Advisers LLC and Beacon Capital Management LLC, have also made moves in Chubb, reflecting confidence in the company’s long-term prospects.

Congressional Investments

Chubb has attracted bipartisan interest from Congress members, becoming the third most purchased stock over the past 90 days. Three members of Congress bought Chubb stock a total of four times, with a combined investment of nearly $100,000. Although this amount is relatively small compared to investments in tech stocks like Nvidia and Broadcom, it signifies a strong belief in Chubb’s value as a stable and reliable investment.

Analyst Ratings and Future Outlook

Analyst Ratings

Chubb has received various ratings from analysts, with an average rating of “Hold.” The stock has one sell rating, eleven hold ratings, eight buy ratings, and one strong buy rating. The consensus target price is $274.70, indicating a potential downside of 3.49% from the current price of $289.57. Despite the mixed ratings, the overall sentiment leans towards stability and moderate growth.

Future Earnings and Revenue Projections

For the current quarter, Chubb is expected to post earnings of $4.86 per share, reflecting a year-over-year decline of 1.8%. The consensus earnings estimate for the current fiscal year is $21.21 per share, indicating a decline of 5.9% from the previous year. However, for the next fiscal year, the earnings estimate is projected to be $23 per share, representing an increase of 8.4% year-over-year.

In terms of revenue, Chubb achieved $13.86 billion in the last reported quarter, marking a year-over-year increase of 13.2%. The consensus sales estimate for the current quarter is $15.13 billion, suggesting a growth of 7.4% compared to the same quarter last year. The estimates for the current and next fiscal years are $56.37 billion (10.4% growth) and $60.37 billion (7.1% growth), respectively. These projections indicate a positive long-term outlook for Chubb, despite short-term earnings fluctuations.

Insider Activity and Market Sentiment

Insider Transactions

Insider activity can provide valuable insights into a company’s future prospects. Recently, Chubb’s CEO, Evan G. Greenberg, sold 30,318 shares at an average price of $289.60, totaling approximately $8.78 million. While insider selling can sometimes be perceived negatively, it is essential to consider the broader context and other factors influencing such decisions.

Market Sentiment

The overall market sentiment towards Chubb remains positive, driven by its strong financial performance, consistent dividend growth, and low volatility. The company’s ability to exceed earnings expectations and deliver robust revenue growth has bolstered investor confidence. Additionally, Chubb’s status as a Dividend Aristocrat and its low payout ratio make it an attractive option for income-focused investors.

Conclusion

Chubb Limited’s strong financial performance, consistent dividend growth, and low volatility have made it an attractive investment option for Congress members and institutional investors alike. The company’s impressive revenue and earnings growth, coupled with its commitment to returning capital to shareholders, underscore its stability and long-term potential. Despite mixed analyst ratings and short-term earnings fluctuations, Chubb’s positive long-term outlook and robust market position make it a compelling choice for investors seeking a reliable and stable investment in the insurance sector.

In summary, Chubb Limited’s appeal lies in its solid financial foundation, consistent dividend growth, and low volatility, making it an underrated yet highly promising investment. The bipartisan interest from Congress members further highlights the company’s potential as a stable and reliable investment option. As Chubb continues to deliver strong financial results and maintain its commitment to shareholder returns, it is poised to remain a favored choice among investors seeking long-term growth and stability.

Related Articles

Category

You may also like

No related articles available

Breaking News

View All →No topics available at the moment