MarketLens

Alibaba Stock Surges 13% as AI Dreams Outweigh E-Commerce Reality—But PDD and JD Are Playing Different Games

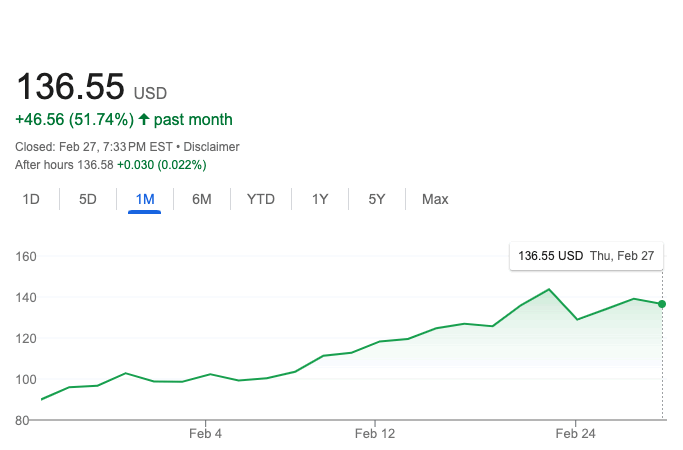

Alibaba's (BABA) stock rocketed 13% on August 29, 2025, hitting $135 per share in a stunning rally that had investors cheering—despite the Chinese e-commerce giant actually missing revenue expectations. The secret sauce? Wall Street is betting big on Alibaba's AI transformation story, even as the company bleeds cash to keep up with rivals PDD Holdings (PDD) and JD.com (JD) in China's brutal e-commerce war.

But here's what makes this story fascinating: all three of China's e-commerce titans are essentially gambling their futures on completely different strategies, and they're all burning mountains of cash to do it.

The Tale of Two Alibabas: AI Powerhouse vs. Struggling Retailer

Let's start with the headline numbers that sent Alibaba soaring. The company reported $34.6 billion in quarterly revenue, actually missing analyst estimates of $35.2 billion. Net income exploded 76% year-over-year to $5.9 billion—but hold your horses. That eye-popping profit came from one-time gains, including selling its stake in Turkish e-commerce company Trendyol. Strip out the financial engineering, and Alibaba's actual operating profit fell 18%.

So why did the stock surge? Two words: artificial intelligence.

Alibaba's Cloud Intelligence division is on fire, posting 26% revenue growth to $4.7 billion. More importantly, AI-related cloud revenue has now maintained triple-digit growth for eight consecutive quarters. CEO Eddie Wu isn't mincing words—he's positioned cloud and AI as Alibaba's primary growth engines going forward.

The company is even developing its own AI chip to reduce dependence on Nvidia, a move that's as much about geopolitics as it is about technology. With U.S.-China tensions making access to advanced semiconductors increasingly uncertain, Alibaba is essentially building its own technological fortress.

But this transformation comes at a steep price. Alibaba burned through $2.6 billion in free cash flow this quarter alone, a dramatic reversal from the $17.4 billion positive flow a year ago. The company has committed a staggering $53 billion over three years to build out its AI and cloud infrastructure.

The Speed Wars: When One-Hour Delivery Isn't Fast Enough

While betting on AI, Alibaba is simultaneously fighting a different battle on the streets of Chinese cities. The company is pouring money into "Taobao Instant Commerce," promising sub-hour delivery to compete with JD.com's legendary logistics network and food delivery giant Meituan.

This isn't just about convenience—it's about survival. Chinese consumers are increasingly expecting their online orders to arrive faster than their pizza delivery. Monthly active users on Taobao jumped 25% in August alone, showing the strategy is working, but at what cost?

The quick commerce push is crushing margins and contributing to that negative cash flow. Alibaba, historically an asset-light marketplace that simply connected buyers and sellers, is now forced to invest heavily in logistics infrastructure—territory where rival JD.com has a decade-long head start.

PDD's All-In Gamble: Blitzkrieg on Two Fronts

If you think Alibaba's strategy is risky, wait until you hear what PDD Holdings is doing. The parent of Pinduoduo and international platform Temu is essentially setting money on fire in pursuit of global domination.

PDD's latest quarterly results tell the story: revenue growth slowed to just 7% (its worst in four years), while operating profit plummeted 21%. The culprit? A massive 36% surge in costs as the company wages war on two fronts simultaneously.

Domestically, PDD is funding a 100 billion yuan merchant support program, essentially paying sellers to keep prices rock-bottom. Internationally, it's bankrolling Temu's aggressive expansion into markets dominated by Amazon, burning cash on marketing and subsidies to build a global customer base from scratch.

PDD's management is refreshingly honest about this strategy, openly prioritizing "long-term impact over short-term results." With $54 billion in cash reserves, they have the firepower for this blitzkrieg approach—but it's a massive gamble that assumes they can outlast competitors in a war of attrition.

| Key Financial Metrics Q2 2025 | Alibaba | PDD Holdings | JD.com |

|---|---|---|---|

| Revenue (USD) | $34.6B | $14.5B | $49.8B |

| Revenue Growth YoY | 2% | 7% | 22.4% |

| Operating Margin | 14% | 24.8% | -0.2% |

| Cash & Investments | $81.8B | $54.0B | $28.8B |

| Market Cap (Aug 29, 2025) | ~$322B | ~$170B | ~$43B |

JD.com's Barbell Strategy: Stable Core, Risky Bets

JD.com is playing a completely different game. While its rivals burn cash across their entire operations, JD is using its profitable retail business as a cash cow to fund ambitious new ventures.

The numbers tell the story: JD posted impressive 22% revenue growth, but swung from a $1.5 billion operating profit to a loss. Marketing expenses exploded 128% as the company launched JD Food Delivery, directly challenging Meituan's dominance.

But here's the clever part: JD's core retail business is actually getting more profitable, with operating margins hitting a record 4.5%. This "barbell strategy" uses the stable, cash-generating retail business to fund high-risk, high-reward ventures like food delivery and international expansion.

It's a more disciplined approach than PDD's all-out assault, but it comes with its own risks. If the new ventures fail to achieve scale, they could drag down the entire company.

The Three-Way Split: What It Means for Investors

The Chinese e-commerce landscape has fundamentally changed. The old battle over who could sell the most stuff online is over. The new war is being fought on two fronts:

The Technology Stack Battle: Who will own the AI and cloud infrastructure that powers the next generation of e-commerce? Alibaba is betting its entire future on becoming China's AWS.

The Logistics Arms Race: Who can deliver products the fastest? All three companies are pouring billions into ever-faster delivery networks, with "instant commerce" becoming table stakes.

| Strategic Focus Areas | Alibaba | PDD | JD.com |

|---|---|---|---|

| Primary Bet | AI & Cloud Infrastructure | Global Low-Price Leadership | Diversification into Services |

| Key Investment | $53B in AI/Cloud over 3 years | Temu international expansion | Food delivery & logistics |

| Biggest Risk | AI narrative fails to deliver | Cash burns before achieving scale | New ventures never profitable |

| Competitive Advantage | Ecosystem & technology leadership | Price & social commerce model | Logistics excellence |

Wall Street's AI-Powered Take: The Algorithms Are Bullish

Adding another layer to the story, AI-powered research platform Kavout is sending strong buy signals on Chinese e-commerce stocks. According to their latest watchlist analysis, both Alibaba (BABA) and PDD Holdings (PDD) earn "Outperform" ratings with "High" stock rankings, while JD.com (JD) sits at "Neutral" with a "Medium" ranking.

The year-to-date returns tell the story: Alibaba is up a stunning 61.92% in 2025, while PDD has gained 23.95% despite its margin pressures. JD, meanwhile, is down 7.72%, reflecting investor concerns about its aggressive expansion strategy.

| Stock | Current Price | YTD Return | Kavout Rating | Stock Rank | Market Cap |

|---|---|---|---|---|---|

| BABA | $135.00 | +61.92% | Outperform | High | $301.67B |

| PDD | $120.22 | +23.95% | Outperform | High | $166.96B |

| JD | $31.07 | -7.72% | Neutral | Medium | $41.99B |

Source: Kavout AI Research Platform. Build your own watchlist at kavout.com/watchlist

This algorithmic optimism on Alibaba and PDD suggests that quantitative models are seeing value in their transformation strategies, despite the near-term margin pressure. The divergence between JD's operational strength (22% revenue growth) and its stock performance (-7.72%) creates an interesting contrarian opportunity for value hunters.

The Bottom Line: High Stakes, No Guarantees

For investors, the message is clear: these aren't your father's e-commerce stocks anymore. Each company is making a massive, transformative bet that will either secure their dominance for the next decade or leave them vulnerable to disruption.

Alibaba is no longer just an e-commerce play—it's a bet on China's AI future. If the cloud and AI narrative pays off, the stock could have significant upside. But if AI growth slows or the core commerce business deteriorates faster than expected, that 13% pop could quickly reverse.

PDD is the high-risk, high-reward option. Its massive cash pile gives it runway, but burning money on two continents simultaneously is a dangerous game. If Temu fails to achieve sustainable profitability or domestic competition intensifies further, that $54 billion war chest could evaporate quickly.

JD.com might be the dark horse. Trading at just $43 billion market cap compared to Alibaba's $322 billion, it offers the most disciplined growth strategy. Its profitable core gives it staying power, even if new ventures take longer to pay off.

The era of easy money in Chinese e-commerce is over. These three giants are now locked in a capital-intensive battle for technological and logistical supremacy. For investors willing to stomach the volatility, the rewards could be substantial—but only if you pick the right horse in this three-way race.

As the companies report earnings throughout 2025, watch these key metrics: Alibaba's cloud growth rate and AI revenue, PDD's cash burn rate versus Temu's user growth, and JD.com's ability to maintain core profitability while scaling new ventures. The winners and losers in this new era of Chinese tech won't be determined by who sells the most products, but by who successfully transforms their business model for the AI age.

Want to make smarter investment decisions in Chinese tech stocks? The AI-powered analysis that spotted Alibaba and PDD as outperformers is just the beginning. Subscribe to Kavout Pro to access advanced research agents, real-time AI stock rankings, and deep analysis tools that help you identify opportunities before the market catches on. Whether you're tracking e-commerce giants or hunting for the next big tech transformation story, Kavout's AI tools give you the edge professional investors rely on.

Related Articles

Category

You may also like

No related articles available

Breaking News

View All →No topics available at the moment