Introducing InvestGPT: Actionable Insights & Analysis for Investors via Natural Language

In the evolving landscape of financial investment, artificial intelligence (AI) has emerged as a pivotal tool, reshaping the way investors analyze stocks and construct portfolios. AI’s integration into the financial sector is multifaceted, encompassing the generation of investment scenarios, sentiment analysis, and the optimization of portfolio mixes.

Kavout unveils InvestGPT, a cutting-edge tool powered by next-generation AI, designed to democratize the investment landscape. It offers investors accessible insights and research, enabling seamless discovery and analysis of stocks through natural language.

InvestGPT leverages AI and natural language processing (NLP) to provide actionable insights, AI-generated analyses, and sophisticated stock screening using financial ratios and factors. This enhances investors’ decision-making by offering a deeply informed perspective on the transformative potential of these technologies.

Decision-Making Based on Analyst Views

Analyst recommendations are pivotal in shaping investor sentiment and actions. These recommendations, ranging from “buy” to “sell,” are informed by rigorous analysis of financial statements, management commentary, industry trends, and broader economic indicators.

Investors often use analyst ratings as a starting point for their investment decisions. A “hold” rating, for example, implies that the stock is expected to perform in line with the market, and investors may decide to maintain their current position. An “equal-weight” rating indicates that the stock’s performance is projected to be average relative to the analyst’s coverage universe.

Price targets are quantifiable expectations set by analysts, projecting where the stock price could head over a specific period, typically one year. These targets are derived from valuation models that consider factors such as earnings growth, market conditions, and company-specific catalysts.

Analyst recommendations and price targets serve as essential tools for investors, providing guidance through the complexities of the stock market. While bullish upgrades and raised targets can signal strong company prospects.

Sentiment Analysis

Sentiment analysis in the stock market is a barometer of the prevailing mood among investors, influenced by analyst ratings, price targets, and broader market trends. It encompasses the general optimism or pessimism towards specific stocks or the market as a whole.

The sentiment can be gleaned from the tone of analyst recommendations, the direction of price target revisions, and the overall market performance. A series of upgrades or raised price targets generally conveys bullish sentiment, while downgrades or lowered targets may signal bearishness.

Now investors can search through the information at Kavout using InvestGPT with natural language at ease. Please replace the tickers with the ones you want to check in the “Ask InvestGPT …” search box.

Analyst Price Target

What is the analyst price target for MSFT stock?

Analyst Recommendations

What are the latest analyst recommendations for AMZN?

Stock Sentiment

What is the social sentiment analysis for AAPL stock?

Latest News

Provide a summary of the latest news for MSFT stock

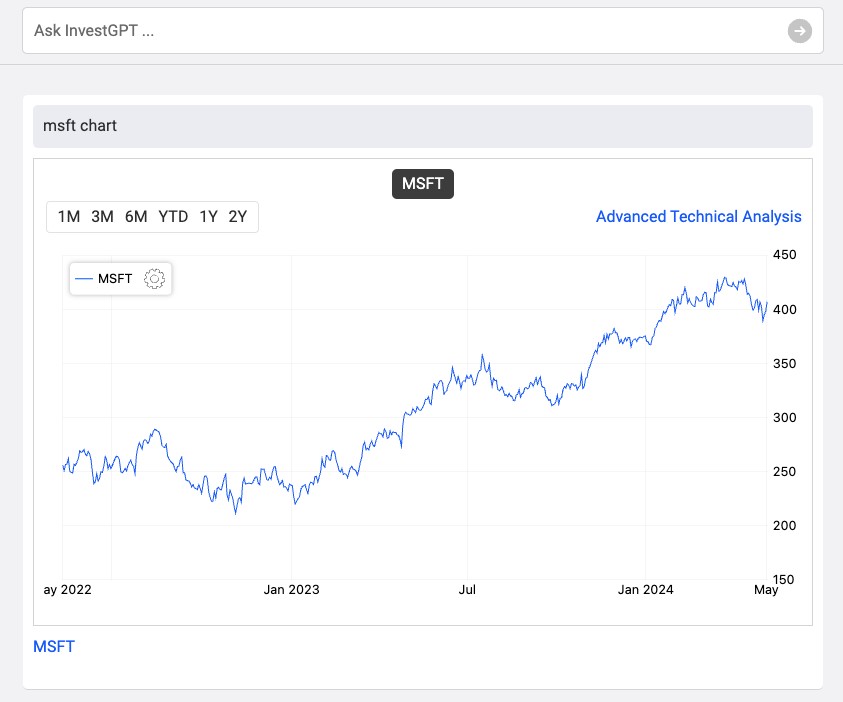

You could also easily pull out any stock chart easily by typing:

Plot stock chart for Microsoft or just Ask InvestGPT with: MSFT Chart

Financial Ratios and Factors

AI technology enables the analysis of vast amounts of financial data, including key ratios and factors such as value, quality, momentum, and growth. These metrics are critical for screening stocks, as they provide a snapshot of a company’s financial health and future prospects.

For instance, the price-to-earnings (P/E) ratio can indicate whether a stock is over or undervalued relative to its earnings. The debt-to-equity ratio gives insight into a company’s financial leverage, while the return on equity (ROE) measures profitability relative to shareholders’ equity.

Financial Ratios

What are the PEG ratios for AMZN and BABA?

Comparative Analysis

How has Visa’s operating margin compared to Mastercard?

Dividend Stocks

Find healthcare stocks with dividend yield > 3% and market cap > 10 billion

Bullish Small Cap Stocks

Stocks with double bottom and market cap < 2B

Top Performer

Among SDY, VlG, and DVY, which had the highest 12-month return

High ROIC Financial Firms

Finance stocks with ROIC > 10%, debt to equity ratio < 1,and dividend yield > 2%

Energy Sector Value Plays

Search for energy stocks with P/B ratio < 1.5, dividend yield > 4%,and price > 5

Retailers Bouncing Back

Healthcare Dividend Growers

Value Picks in Consumer Goods

Find consumer goods stocks with P/B ratio < 2, debt to equity ratio < 0.5,and dividend yield > 3%

Undervalued Large-Cap Tech Stocks

AI in Stock Pattern Analysis

In the realm of stock market trading, the ability to identify and predict chart patterns has long been a coveted skill among traders and investors. With the advent of artificial intelligence (AI), the landscape of technical analysis has undergone a significant transformation. AI-driven tools are now capable of recognizing and interpreting classic chart patterns with a level of precision and speed unattainable by human analysts alone.

Kavout have introduced features that enable users to effortlessly discover stock ideas based on chart and candlestick patterns. The AI-powered software scans the market to identify stocks exhibiting profitable patterns, thus streamlining the stock selection process for investors.

Bullish Double Bottom

Large cap stocks with double bottom pattern

V Bottom Pattern

Find tech stocks with V Bottom

Bull flag low price stocks

Find stocks with bull flag and price < 10

AI-Driven Candlestick Pattern Recognition

Candlestick patterns are a method of representing price movements in a security over a specific timeframe. These patterns are a visual aid for market participants to understand market sentiment and make predictions about future price movements. The recognition of these patterns can be crucial for making informed trading decisions. Traditionally, traders have relied on their expertise and experience to spot these patterns, but the complexity and volume of market data make this task challenging.

Kavout automatically scans the market to identify stocks that exhibit popular and profitable patterns, such as Head and Shoulders, Cup and Handle, and more. This feature enables users to effortlessly discover stock ideas based on chart and candlestick patterns.

Candlestick Patterns

Dark Cloud Cover

Stocks with Dark Cloud Cover and market cap < 2B

Mid-cap Doji Stocks

Mid cap stocks with Doji and price > 10

Early Release of InvestGPT for US Stocks & ETFs

We at Kavout are super excited to release InvestGPT to offer our users a transformative approach to stock screening, providing comprehensive, data-driven insights and in-depth analysis that can enhance their decision-making process. Investors who adeptly utilize these tools can position themselves advantageously in the market, capitalizing on the sophisticated analysis that AI affords.